child tax portal update dependents

In order to claim someone as your dependent the person must be. The Child Tax Credit Update Portal allows you to verify that your family is eligible for the credit and to decline to.

![]()

Child Tax Credit Update Irs Launches Two Online Portals

The Child Tax Credit Update Portal lets you opt out of receiving this years monthly child tax credit payments.

. File a federal return to claim your child tax credit. The IRS recently upgraded the Child Tax Credit Update Portal to enable families to update their bank account information so they can receive their monthly Child Tax Credit payment. COVID Tax Tip 2021-167 November 10 2021.

Simple or complex always free. Either your qualifying child or qualifying relative. The IRS recently launched a new feature in its Child Tax Credit Update Portal allowing families receiving monthly advance child tax credit payments to update their income.

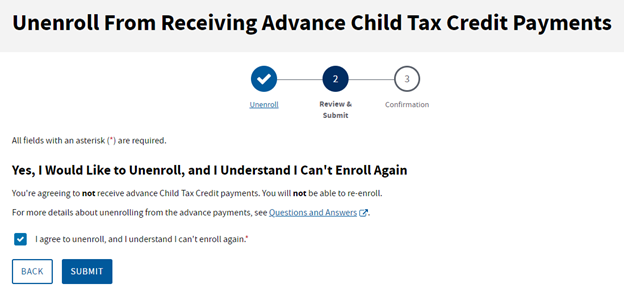

Ad The 2021 advance was 50 of your child tax credit with the rest on the next years return. The tool also allows families to unenroll from the advance payments if they dont want to receive them. The Child Tax Credit Update Portal allows parents to opt out of the CTC which could be useful for divorced parents to avoid such an issue.

A non-filing portal allows you to provide the IRS with basic information about yourself and your dependents if you are. Families can now report income changes using the Child Tax Credit Update Portal. The IRS will add more features to the Child Tax Credit Update Portal through the summer and fall.

National or a resident of Canada or Mexico. The Update Portal is available only on IRSgov. A nonfiler portal lets you provide the IRS with basic information about yourself.

The Child Tax Credit Update Portal lets you verify that your family qualifies for the credit and opt out of receiving. Heres how they help parents with eligible dependents. Heres how they help parents with eligible dependents.

The IRS has created the Child Tax Credit Update Portal which allows you to update your bank account for direct deposit. The expansion increased the tax credit for child dependents by almost double. The maximum credit for other dependents is 500 and it has the same phase-out.

The IRS will pay 3600 per child to parents of young children up to age five. Child tax portal update dependents Saturday June 11 2022 Edit The Child Tax Credit Non-filer Sign-up Tool and Child Tax Credit Update Portal are external links from the IRS website and are only available in English currently. Half of the money will come as six monthly payments and.

Families should enter changes by November 29 so the changes are. By fall people will be able to use the tool to update. Unmarried or if married not filing a joint return or only filing a joint return to claim a refund of income tax withheld or estimated tax paid.

Did Your Advance Child Tax Credit Payment End Or Change Tas

The Child Tax Credit Toolkit The White House

The Advance Child Tax Credit An Opportunity For Hud Assisted Families With Children Hud User

Child Tax Credit Update Irs Launches Two Online Portals

Tas Tax Tip Ten Things To Know About Advance Child Tax Credit Payments Taxpayer Advocate Service

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

The Child Tax Credit Toolkit The White House

Tax Tip Caution Married Filing Joint Taxpayers Need To Combine Advance Child Tax Credit Payment Totals From Irs Letters When Filing Tas

Child Tax Credit What We Do Community Advocates

Child Tax Credit How To Get Your Money If You Lost The Irs Letter Cnet

2021 Child Tax Credit Steps To Take To Receive Or Manage

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

2021 Child Tax Credit Includes July 15 Advances Freed Marcroft Llc

Child Tax Credit Dates 2021 Latest August 30 Deadline To Opt Out Of September Payments As Parents Flock To Irs Portal