kaufman county tax assessor collector

Kaufman County collects on average 2 of a propertys assessed fair market value as property tax. Kaufman County Tax Assessor - Collector Kaufman County Annex 100 North Washington Kaufman TX 75142.

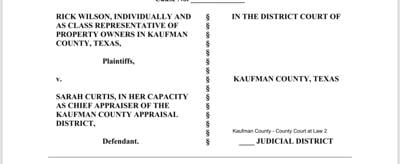

Forney Mayor Files Suit Against County Appraisal District Business Inforney Com

Start Your Homeowner Search Today.

. A convenience fee of 229 will be added if you pay by credit card. Kaufman Texas 75142. For more information please visit Kaufman Countys Auditor and Treasurer or look up this propertys current tax situation here.

116-908-02 Quinlan Independent School District. P O Box 339 Kaufman TX 75142. 972 932 4331 Phone The Kaufman County Tax Assessors Office is located in Kaufman Texas.

The Appraisal District is giving public notice of the capitalization rate to be used each year to appraise property receiving an exemption under Section 111825 of the Property Tax Code for Organizations Constructing or Rehabilitating Low-Income Housing. Certain types of Tax Records are available to the. Get a Complete Report on County Property Records in Less than Two Minute.

View 2368 Sonesh Circle Kaufman Texas 75142 property records for FREE including property ownership deeds mortgages titles sales history current historic tax assessments legal parcel structure description land use zoning more. The official address is 100 North Washington Street Kaufman Texas 75142. Name Kaufman County Assessors Office Address 100 North Washington Street Kaufman Texas 75142 Phone 972-932-0288 Fax 972-932-1413.

Information provided for research purposes only. Contact information for the following CAD Districts are as follows. Contact your local County Appraisal District and they will be able to assist you with any exemption qualification questions.

Ad Get In-Depth Property Tax Data In Minutes. Kaufman County Tax Assessor - Collector Kaufman County Annex 100 North Washington Kaufman TX 75142. Having trouble searching by Address.

See reviews photos directions phone numbers and more for County Tax Assessor Office locations in. 100 N Washington St. After authorization of your payment you will be given a confirmation.

Kaufman County Tax Office. Kaufman County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Kaufman County Texas. Paying your property tax.

The Texas Tax Code establishes the framework by which local governments levy and collect property taxes. You can pay your property taxes by calling 1-800-2PAY-TAX 1-800-272-9829. Use UpDown Arrow keys to increase or decrease volume.

Ad Pay Your Taxes Bill Online with doxo. May I pay my taxes by phone in Kaufman County TX. The Kaufman County Tax Collectors role is to manage financial transactions that include various tax operations.

Contact your local County Appraisal District and they will be able to assist you with any exemption q. Ad Need Property Records For Properties In Kaufman County. See Property Records Deeds Owner Info Much More.

A convenience fee of 229 will be added if you pay by credit card. Actual taxes might differ from the figures displayed here due to various abatement and financial assistance programs. Kaufman County Tax Assessor - Collector.

At the prompt enter Jurisdiction Code 6382. The fee will appear as a separate charge on your credit card bill to Certified Payments. These can consist ofissuing county tax bills property tax payments and more.

There is a fee of 150 for all eChecks. Kaufman County Assessors Office Contact Information. 13th Street Suite 2 Corsicana Texas 75110 903 654-3080 Mailing Address.

You can pay your property taxes by calling 1-800-2PAY-TAX 1-800-272-9829. Seeing too many results. Box 339 Kaufman TX 75142-0339.

Find the Right Mover for Me. You can contact the Kaufman County Assessor for. Remember to have your propertys Tax ID Number or Parcel Number available when you call.

Summary of Certified Roll. Legal descriptions and acreage amounts are for appraisal district use only and should be verified prior. Please contact the Appraisal District to verify all.

Kaufman County Assessors Office Contact Information. There is a fee of 150 for all eChecks. In the US each state has an office in charge of property assessment and the name of the office differs from state to state.

Address Phone Number and Fax Number for Kaufman County Assessors Office an Assessor Office at North Washington Street Kaufman TX. Vehicle Registration 469-376-4688 or Property Tax 469-376-4689 Kaufman County Tax Office Locations. Property Not Previously Exempt2022 Low Income Housing Apartment Capitalization Rate.

County tax assessor-collector offices provide most vehicle title and registration services including. These records can include Kaufman County property tax assessments and assessment challenges appraisals and income taxes. Get driving directions to this office.

Visit Our Website Today To Get The Answers You Need. 100 N Washington St. Name Kaufman County Tax Collector Address 100 North Washington Street Kaufman Texas 75142 Phone 972-932-0288 Fax 972-932-1413.

Registration Renewals License Plates and Registration Stickers. To pay by telephone call 1-866-549-1010 and enter Bureau Code 5499044. Name Kaufman County Tax Collector Address 100 North Washington Street Kaufman Texas 75142 Phone 972-932-0288 Fax 972-932-1413.

You can call the Kaufman County Tax Assessors Office for assistance at 972-932-4331. If you have general questions you can call the Kaufman County. Having trouble searching by Address.

The minimum convenience fee for credit cards is 100. Search Valuable Data On A Property. Name Kaufman County Assessors Office Address 100 North Washington Street Kaufman Texas 75142 Phone 972-932-0288 Fax 972-932-1413.

714893971 Certified Taxable Value. Please call the assessors office in Kaufman before you send documents or if you need to schedule a meeting. Your property tax bill.

129-901-02 Crandall Independent School District. Such As Deeds Liens Property Tax More. There is a fee of 150 for all eChecks.

Kaufman County Tax Assessor - Collector. The Appraisal District is giving public notice of the capitalization rate to be used each year to appraise property receiving an exemption under Section 111825 of the Property Tax Code for Organizations Constructing or Rehabilitating Low-Income Housing. 129-000-00 Kaufman County.

County Treasurer Kaufman County

Censored Property Taxes Texas Hunting Forum

New Chief Appraiser Named News Kaufmanherald Com

Kaufman Central Appraisal District Facebook